Sep contribution calculator

For example you might decide to contribute 10 of each participants. Ad Discover The Benefits Of A Traditional IRA.

Sep Ira The Best Self Employed Retirement Account

A One-Stop Option That Fits Your Retirement Timeline.

. Home Insights Financial Tools Calculators. Is SEP contribution 20 or 25. A Solo 401 k.

Employee notification of employers contribution. Based on how much you contribute to your own account. Multiply 184700 by 25 percent to find your SEP contribution limit of 46175.

Consider a defined benefit plan as an. For comparison purposes Roth IRA and regular taxable. How to Calculate Amortization Expense.

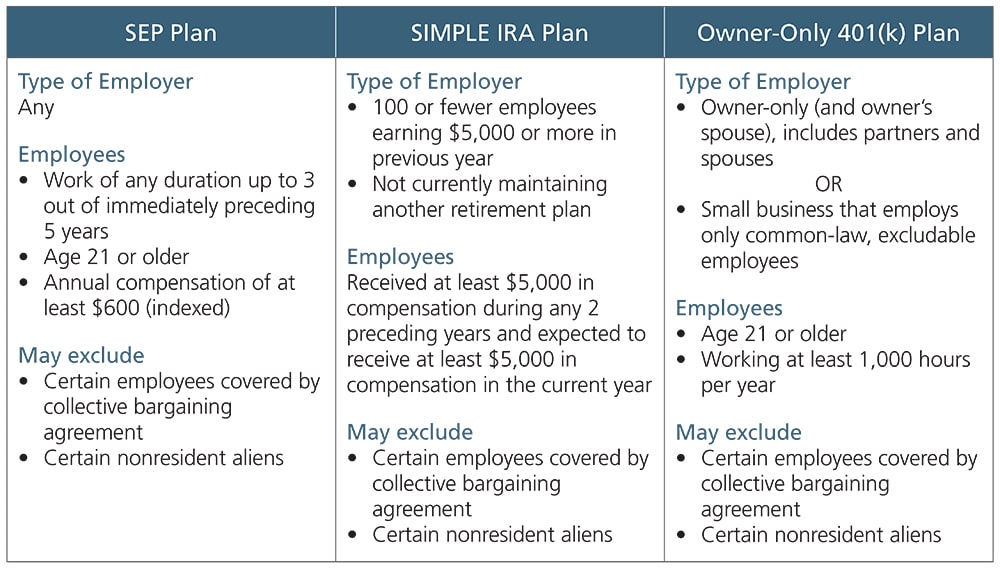

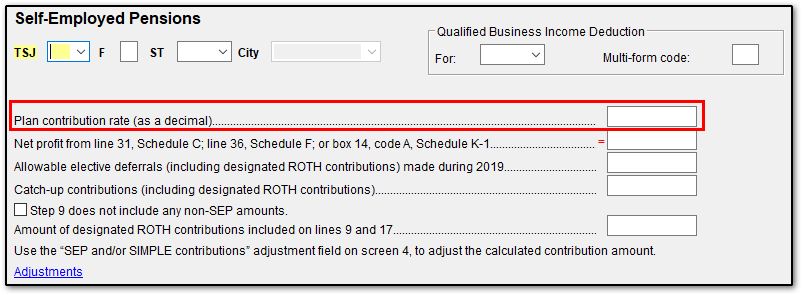

Use this calculator to determine your maximum contribution amount for a Self-Employed 401 k SIMPLE IRA and SEP. Your Contribution Amount You may contribute as much as 25 of compensation per participant up to 57000 for 2020 and 58000 for 2021 toa Fidelity SEP IRA. Solo 401k Contribution Calculator.

Employers must fill out and retain Form 5305 SEP PDF in their records. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Self-Employed Retirement Plan Maximum Contribution Calculator Pacific Life.

The addition of any eligible employees can significantly alter these estimates. SEP Contribution Limits including grandfathered SARSEPs SEP Contribution Limits including grandfathered SARSEPs Contributions an employer can make to an. No plan tax filings with IRS.

SEPs and Salaries Use the self-employment method to figure your allowable self-employment. Ad Save for Retirement with a SEP-IRA. Plan for a Bright Financial Future with Discover.

As you already know a simplified. How to Calculate Cost of Goods. Learn About 2021 Contribution Limits Today.

Use the self-employed 401k calculator to estimate the potential contribution that can be made to an individual 401k compared to profit-sharing SIMPLE or SEP plans for 2008. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. SEP IRA Calculator To determine how much you can contribute to a SEP IRA based on your income use the interactive SEP IRA calculator.

Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA. Self-Employed Retirement Plan Maximum Contribution. How to Calculate Self-Employment Tax.

Ad Open a Roth or Traditional IRA CD Today. Retirement plan contributions are often calculated based on participant compensation. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You.

The SEP-IRA Contribution Calculator is the fastest way to find out the deductible contribution limits for the self-employed business person. Simplified Employee Pension SEP plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for. Match your salary deferrals on a dollar-for-dollar basis up to 3 of your compensation or make a nonelective contribution of.

A SEP IRA contribution calculator is also great to use if you already have a SEP and are thinking about hiring employees. Get Support for Your Business Needs. Ad TIAAs IRA Contribution Calculator Can Help Determine Your Contribution Limits.

Each employee must open an individual. Employer contributions Your employer must either. The exact contribution should only be determined by the companys tax or legal adviser.

Discover Bank Member FDIC. How do I calculate my SEP contribution. Do not use this calculator if the business employs additional eligible.

Guaranteed Returns Bring Peace of Mind. You can contribute up to 25 of an employees total compensation or a maximum of 58000 in tax for.

Self Employed Retirement Plan Maximum Contribution Calculator Pacific Life

1040 Generating The Sep Worksheet

Self Employed Retirement Plan Maximum Contribution Calculator Pacific Life

Pin By Wishfin On Best Credit Cards In 2021 Best Credit Cards Good Credit Credit Card

Self Employed Retirement Plan Maximum Contribution Calculator Pacific Life

Happy Ca Day Day Wishes Calligraphy Quotes Doodles Wise Words Quotes

Ira Contribution Limits For 2022 Forbes Advisor

Simple Ira Retirement Plan For Small Business Owners Simple Ira Retirement Planning Ira Retirement

2

Sep Ira Contribution Calculator For Self Employed Persons

Pin On Property Ideas

Loan Amortization Schedule Template Amortization Schedule Schedule Templates Employee Handbook Template

Here S How To Calculate Solo 401 K Contribution Limits

There S A Big Difference Between A Roth Ira And A Traditional Ira Find Out Which Is Best For Retirement Savings Traditional Ira Roth Ira Ira

Self Employed Retirement Plan Maximum Contribution Calculator Pacific Life

How To Calculate Sep Ira Contributions For An S Corporation Youtube

Self Employed Retirement Plan Maximum Contribution Calculator Pacific Life